Why Successful Companies are Choosing to Stay Private—and How Investors Can Adapt

Regulations and market volatility mean that growing companies are staying private longer—or potentially never list on the public markets at all. That shift has real implications for individual investors.

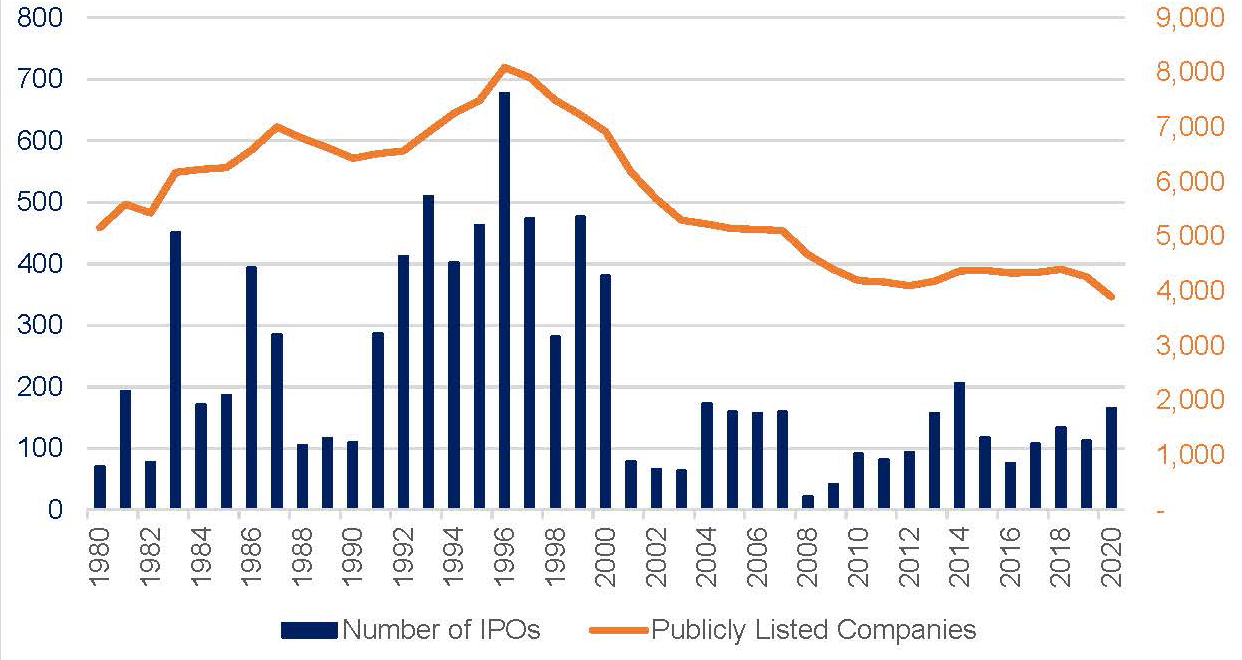

Sep 29, 2021 - Over the past 30 years, the number of publicly listed companies on U.S. exchanges has fallen sharply. Consider that in the late 1990s, there were more than 8,000 listed companies in the U.S. By 2020, there were less than 4,000. As of the first half of 2021, there were 4,155 listed companies, which is still low by historical standards.1

Some of the decline comes from delistings—i.e., public companies that either go out of business or merge with another firm. But the bigger decline is due to a reduction in IPOs (Initial Public Offerings). In the late 1990s, there were well over 400 IPOs on average, fast forward to 2020, there were 165.2 It will be interesting to watch what happens in 2021 as there has been a recent increase in IPOs compared to previous years.

SOURCE: : “Listed Domestic Companies, Total,” The World Federation of Exchanges, 2020. Jay Ritter, "Initial Public Offerings: Updated Statistics," University of Florida, June 2, 2021.

For your clients, it’s helpful to understand why this trend is taking place, how it might affect their portfolios, and if they should consider adjusting their investment strategy.

Several Factors Behind the Trend

There are several reasons why companies are staying private longer. One, is that there are significant costs to publicly list a company. These costs can vary widely depending on a number of factors, but to give a general idea they can range from $2.6M for smaller deals to upwards of $58M for larger deals.3 There’s also a requirement of management to file financial statements and other disclosures as per the SEC rules, and meet with institutional investors. That burden is particularly heavy on early-stage companies, which may not have the organizational resources to do it all.

Being publicly traded also exposes companies to daily market volatility. Publicly traded companies need to meet quarterly earnings targets and shareholder expectations, and market sentiment can often be driven by emotions and short-term thinking rather than a company’s long-term performance. Finally, some companies are able to access capital from other sources, meaning they don’t need to sell equity to the public in order to fund their continued growth.

Why It Matters

The decline in public companies may have a real impact on your clients. Why? When companies wait longer to go public, they may already be past some of their highest-growth years.4 Investors who only invest in public companies are potentially missing out. These investors may be concentrated among a smaller number of stocks, meaning they could be less diversified. Meanwhile, investors who have access to private companies, while this can be riskier and illiquid, could have an advantage since some of these companies may still be in their peak growth years and there is a bigger universe of options to invest.

For your clients, the implication is that many investors may need to look wider in order to gain exposure to the overall U.S. economy and remain diversified. This could mean considering a broader set of investments, including alternatives, such as private capital. Stocks still have a role in many investors’ portfolios. But they shouldn’t be the sole focus.

1 “Listed Domestic Companies, Total,” The World Federation of Exchanges, 2020

2 Jay Ritter, "Initial Public Offerings: Updated Statistics," University of Florida, June 2, 2021

3 “Considering an IPO? First, understand the costs.” PWC.com, accessed June 22, 2021.

4 Nancy Tengler, “Companies are Staying Private Longer, Should You Invest Pre-IPO?” USAToday.Com, Sept. 27, 2020.

CSC-0921-1695592-INV