Jan. 27, 2026 – Exit planning isn’t just about selling a business—it’s a key part of protecting wealth, preserving a legacy and ensuring peace of mind for years ahead. With most business owners holding the majority of their net worth inside the business, the lack of diversification can create risks. And when the time to exit arrives, the process can feel overwhelming and unfamiliar.

To assist clients in this situation, you do not need to have all the answers to serve as the quarterback and trusted guide throughout the process. Instead, focus on understanding the common hurdles business owners face when exiting—and knowing which professionals can help address or avoid them.

In this first installment, we’ll explore three essential components of exit planning strategies: financial planning, personal planning and business planning and readiness. Together, these pillars establish the groundwork for a smooth transition and give financial professionals a clear way to help business owners navigate what comes next.

Turning Challenges Into Opportunities

A wave of business sales is coming, and that’s an opportunity for financial professionals.

According to the Exit Planning Institute® (EPI), 75% of owners plan to sell within the next decade. That works out to about 4.5 million businesses, representing $14 trillion in wealth, yet many owners feel unready:1

- 62% say the process feels overwhelming2

- 56% worry about getting a fair price2

- 53% lack resources or guidance2

About half of businesses in the U.S. are owned by baby boomers, many of whom are looking to retire. At the same time, younger business owners may be seeking more of a work-life balance, or they may want to sell part of the business to raise cash. For all these reasons, exit planning is a growing topic—and a conversation you should be having with the business owners among your clients.

Even with a plan, many owners still lack confidence—16% feel unprepared, and only 37% use a financial professional.3 And business owners who don’t think they’re near to a sale need to think about exit planning. Unexpected events like divorce or disability can force a sale sooner than expected. About 50% of exits are involuntary, and 70% of businesses listed don’t sell.1,4 Family transitions have their own complexity, with only 30% passing to the second generation, and just 12% surviving to the third.1

These challenges highlight why proactive planning matters. That’s where you come in. By guiding clients through business, financial and personal planning, you help them avoid common pitfalls, like the 75% who regret selling within a year, and position them for success.1

How Financial Professionals Can Help

The biggest way you can help business owners is by asking the right questions—the kind that intrigue and empower your clients to take action. If they want to sell, you can help set the process up for success. If unforeseen circumstances force a sale, they’ll be prepared. And if the sale happens, they’ll likely be satisfied with the outcome.

The key questions fall into three interconnected categories:

1. Financial Planning

Question for the business owner: What is your wealth gap?

Of course, a comprehensive financial plan considers more than the outcome of a business sale. In practice, that means planning for both successful and unsuccessful exit scenarios. This preparation helps ensure that your client’s long‑term goals remain on track, even if a sale is delayed or disrupted.

Identifying and closing the wealth gap can be a key part of the exit planning conversation, highlighting the need for a financial plan. Using back-of-the-napkin math, you can estimate retirement needs to support a 30-year retirement by establishing annual post-retirement spending goals and multiplying by 25 to determine total assets required. This calculation reveals the difference between a client’s financial goals and their current assets outside the business.

This discussion gets clients to really think about what kind of financial objectives they have and what kind of resources they need to make that happen. It often underscores how much of a person’s wealth is tied up in the business, and how important a successful exit is to their financial future.

2. Personal Planning

Question for the business owner: What’s your plan for the next phase of life?

Preparing the business and financial plan is essential—but what happens after the sale? Without a clear personal plan, the transition can feel overwhelming and may even lead to regret. Launching and growing a business can be an all-consuming endeavor, and some owners may not have thought much about what they want to do next.

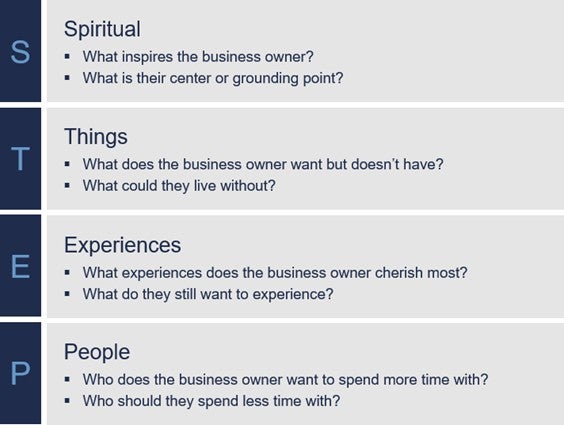

For many, the business was their primary purpose and identity, and after it’s sold, the absence can be disorienting.5 Introducing the S.T.E.P. framework (spiritual, things, experiences, people) can help clients define goals that reflect their values and create a vision for life after the exit.

S.T.E.P. Framework for Life After Business Exit

The S.T.E.P. framework helps business owners define goals that reflect their values and create a vision for life after the exit. The goal is to transition to something—not just away from something.

3. Business Planning and Readiness

Question for business owner: Do you understand the value of your business today?

While some clients may have completed a formal valuation of their business, there are many that are not familiar with the value of their company or how third-party purchasers generally value businesses. For those clients that are more unfamiliar, a financial professional shouldn’t look to provide or replace a formal valuation. Instead, offering general guidance around strategic value—an estimate that helps frame early planning conversations—signals to the business owner that you understand how valuations work and can support them in finding more comprehensive resources.

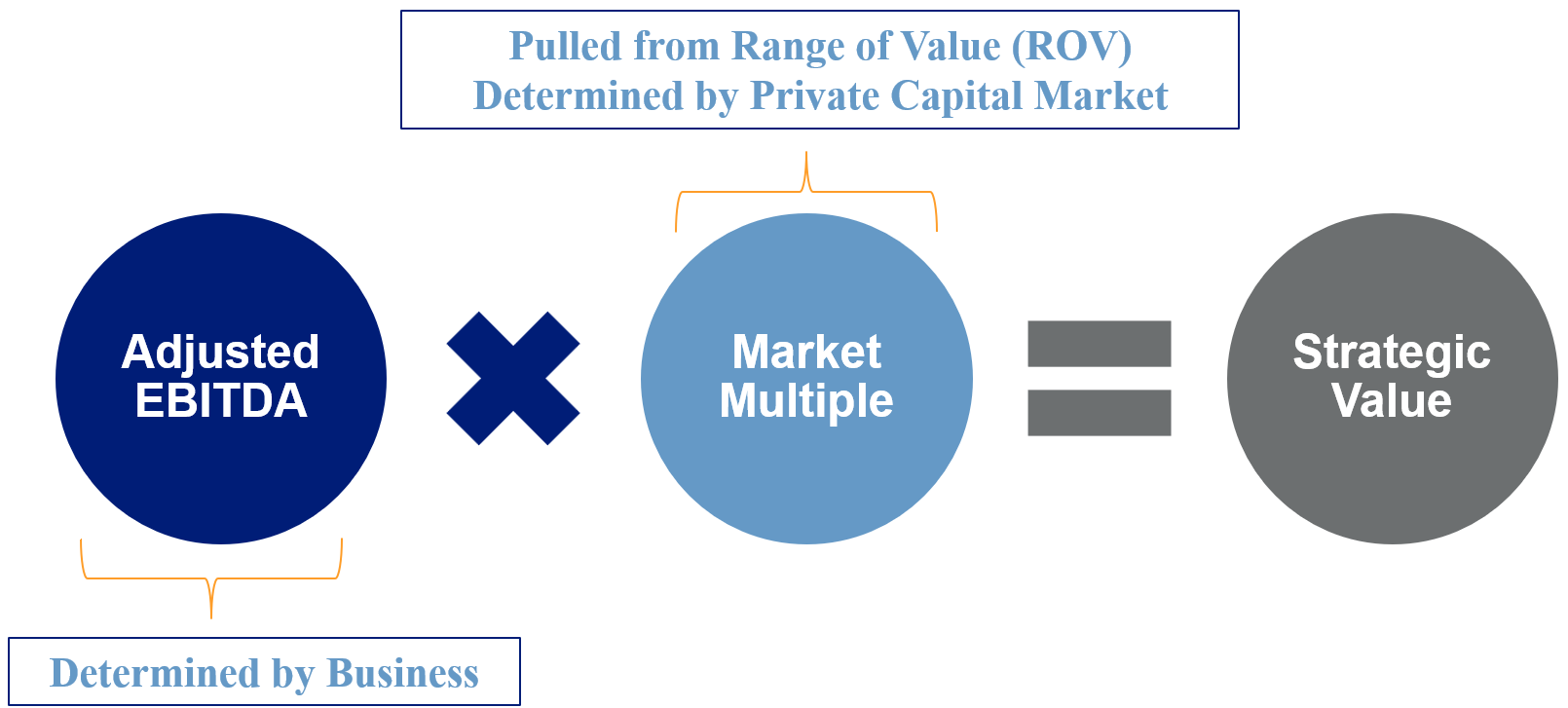

Calculating Strategic Value: A Key Step in Business Planning

The strategic value calculation provides a planning estimate of what a business may be worth. It begins with adjusted EBITDA (earnings before interest, taxes, depreciation and amortization), a common metric used to gauge a company’s operational performance. From there, a market multiple is applied—derived from private‑market data and influenced by the business’s attractiveness, readiness for ownership transfer and level of risk.

Examples of factors that can affect the multiple include growth prospects, market conditions and intangibles such as brand strength and employee culture. Buyers typically look for businesses that can operate independently of the owner, with strong systems, processes and leadership in place.

High owner dependency, a lack of documented procedures or revenue concentration can increase perceived risk and push valuation lower. Reducing these risks and strengthening intangible capital can improve the multiple and make the business more appealing to potential buyers.

Looking Ahead: Common Exit Options and Advanced Strategies

In this first installment, we focused on three foundational components of exit planning: financial planning, personal planning, and business planning and readiness. These pillars help your business owner clients prepare for a successful transition and reduce risk along the way.

In part two, we’ll wrap up the series by covering:

- Common exit options and key considerations

- Building an exit planning team to support every stage of the process

- Addressing business owner hesitation and overcoming barriers to action

Stay tuned for practical strategies and insights to help you guide clients through one of the most significant milestones of their lives.

1 “EPI 2023 State of Owner Readiness Report,” Exit Planning Institute, accessed June 2025.

2 “The Small Business Perspective: Leading Through Change, Shaping a Legacy,” U.S. Bank, June 2025.

3 “A Business Succession Boom is Coming, and One-third of Business Owners Don’t View a Plan as a Priority, Edward Jones Research Finds,” Edward Jones, June 11, 2024.

4 “Lien De Pau, “Why 80% Of Owners Can’t Sell A Business When They Want To,” Forbes, April 9, 2025.

5 “CEO Founders: A 10-Point Checklist for Selling Your Business,” Cresset Capital, accessed December 2025.

The information provided only summarizes complicated topics and does not constitute financial, legal, tax, or other professional advice. Further, the information is not all-inclusive and should not be relied upon as such.

CSC-0126-5076991-INV