Advisor Resources

WHAT IS PRIVATE CAPITAL?

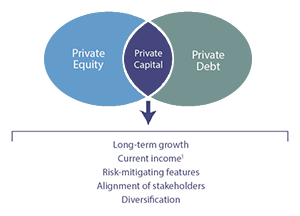

What is private capital? In its simplest form, private capital is a strategy that often owns both the controlling equity and debt in the same private business. This enables the investment portfolio to act as both the owner of and lender to the same private business.

To understand the concept, let’s look at each component of the strategy:

- Traditional Private Equity

- Private Debt

- Combination of Equity and Debt (Private Capital)

Traditional Private Equity

Traditional private equity has experienced strong past performance and generally comes with higher risks and expenses and requires a higher net worth, typically $5 million or more in assets. It is generally included in a portfolio because of the potential for strong growth, but this also means that there is typically no income component. Also, the equity position is at the bottom of the capital stack, which puts investors at a lower repayment priority should the business default.

Private Debt

Private debt is typically added to a portfolio for its income properties. Loans are made to private businesses and may generate income as they are paid back over time. That income can be used to make distribution payments to investors. While private debt offers investors the potential for income, there is no ownership stake which enables investors from participating in growth potential for an expanding business.

Private Capital

Private capital typically combines both equity ownership alongside a debt position in the same private business. The combined aspects of both income and capital appreciation create a total-return investment.1 In short, a private capital investment may generate some of the advantages of private equity while reducing some of the drawbacks.

This investment is speculative, has substantial costs, and differs from traditional private equity. Investors need a clear understanding of the risks and benefits of private capital to determine if it’s right for them. In working with clients to make this assessment, financial professionals should consider a range of factors, such as:

- Investment time horizon

- Risk tolerance

- Suitability

Depending on an investor’s goals, risk tolerance, and other factors, private capital could help increase a portfolio’s diversification while also offering both income and growth potential.

There is no assurance these objectives will be met.

1 Distributions are not guaranteed in frequency or amount. Distributions will be paid from net investment income, offering proceeds, borrowings or reimbursable expense support; the latter three will reduce future cash available for distributions and be dilutive to future shareholders.